27 Questions to Ask Offshore Development Companies Before Hiring One (+ Scoring Framework)

Most CTOs in San Francisco, New York, and Austin waste 6 hours on vendor calls and still hire the wrong offshore partner. Every company claims 95% retention and “seamless integration.” You don’t know which questions to ask offshore development companies that reveal the truth versus rehearsed pitches.

One bad hire costs 6 months and $200K. This offshore development company evaluation framework gives you 27 specific questions across 6 categories. You’ll get good answers, red flags, and automatic dealbreakers.

📋 What You'll Learn in This Guide

Exact questions to ask across 6 evaluation categories

Interactive calculator with objective pass/fail criteria

Specific answers that should end vendor conversations

Automatic disqualifications that override all other scores

Quick Answer

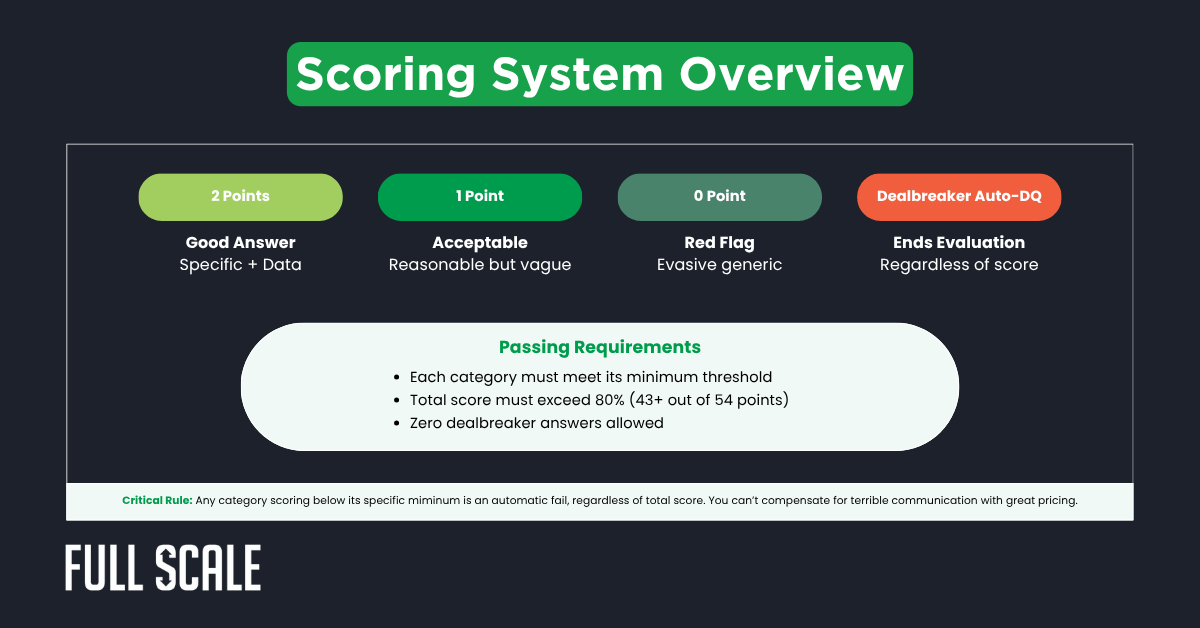

When evaluating offshore development companies, ask 27 questions across 6 categories: Team Structure (5 questions about direct access and timezone overlap), Quality & Vetting (5 questions on acceptance rates and technical assessments), Retention & Stability (4 questions on turnover and backup plans), Pricing & Contracts (4 questions about hidden fees and IP ownership), Integration & Workflow (5 questions on process adaptation), and Cultural Fit (4 questions on values alignment). Score each answer: 2 points for specific data-backed responses, 1 point for acceptable answers, 0 for red flags. Companies scoring below 80% total or failing category minimums don't pass this offshore vendor due diligence test.

Why Most Offshore Development Company Evaluations Waste Your Time

Vendors control the conversation from minute one. They ask what you need, then pitch how they’re different. You nod along and ask generic questions.

They give you rehearsed answers. “We have rigorous vetting.” “Our developers integrate seamlessly.” “We maintain high retention rates.” Every single company says this.

You hang up feeling good. Their deck looks professional, references check out, and pricing seems fair. Six months later, you’re dealing with high turnover and communication breakdowns.

The problem isn’t the vendors lying—most believe their own pitch. The problem is you’re asking questions to ask offshore development companies that don’t expose the truth.

According to Deloitte’s 2024 Global Outsourcing Survey, 64% of companies experienced offshore partnership failures within the first year. The common thread? Poor due diligence during vendor selection.

That’s why you need an objective framework that cuts through the sales pitch.

How to Use This Framework to Vet Offshore Software Companies

This offshore vendor due diligence system scores vendors objectively. You’re not relying on gut feel or polished presentations. You’re using data.

Schedule a 90-minute deep-dive call. Don’t warn them about specific questions ahead of time. Take notes on the exact wording of their answers.

Score immediately after the call while details are fresh. Compare multiple vendors using the same framework. The numbers don’t lie.

Use the interactive calculator below to track scores as you evaluate vendors. It automatically flags category failures and shows you exactly where vendors fall short.

📊 Interactive Vendor Scorecard

Score each answer as you interview vendors. The calculator tracks category minimums and shows whether they pass your offshore hiring due diligence checklist.

Offshore Vendor Evaluation Calculator

Evaluation Results

Want to see how Full Scale scores on all 27 questions?

Book Your Strategy CallNow let’s dive into the six categories and their 27 questions. Each section includes the exact question to ask, why it matters, what good answers look like, and which responses should raise red flags.

Category 1: Team Structure & Communication

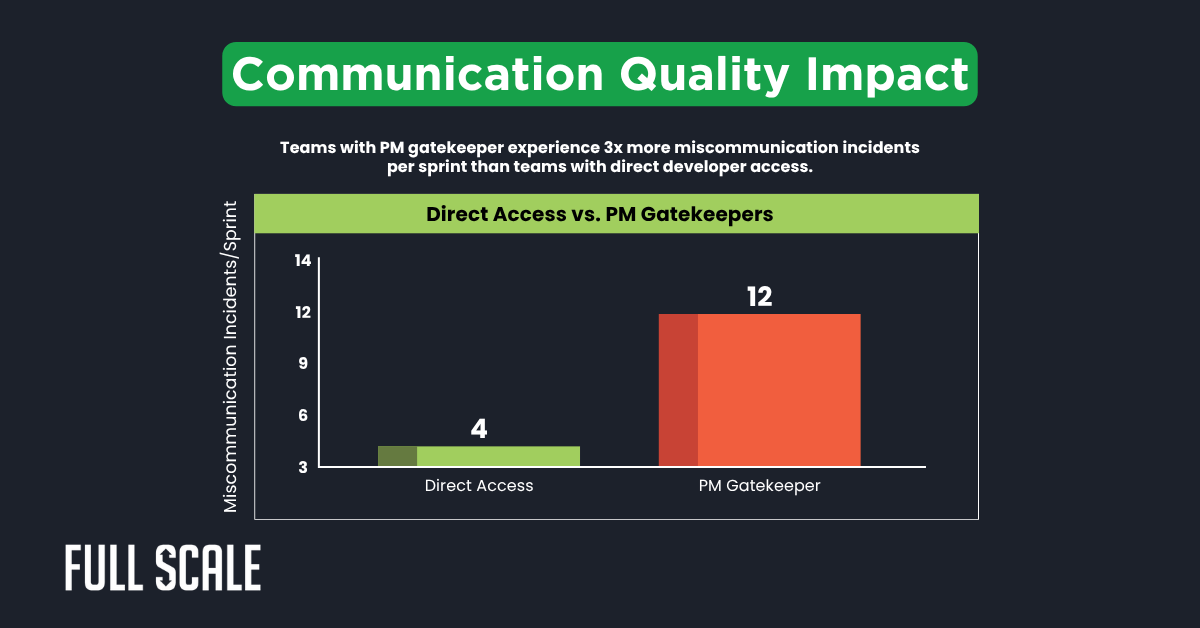

Direct access to developers makes or breaks offshore partnerships. Middlemen create the telephone game that kills velocity. Time zone overlap determines if you’ll get real-time collaboration or async hell.

These offshore company interview questions expose whether you’re hiring a team or renting a black box. Pay attention to how specific their answers get. Vague responses mean they’re hiding something.

Question 1: “Who will I communicate with daily—the actual developers or project managers?”

Why this matters: Project managers as gatekeepers guarantee communication breakdowns.

Good answer (2 points):

- “You’ll have direct Slack and email access to your developers.”

- “We don’t use PMs as middlemen between you and the team.”

- “You communicate exactly like they’re in-house.”

Red flag (0 points):

- “You’ll work with your dedicated project manager who coordinates everything.”

Score: This is a dealbreaker question. No direct access = automatic disqualification.

I’ve seen this destroy partnerships. CTOs tell their teams what to build, and PMs translate it wrong. Developers build something else.

Three months later, you’ve got the wrong product.

Question 2: “What’s your team’s overlap with my timezone? How do you handle real-time collaboration?”

Good answer (2 points):

- “4-hour overlap, 9am-1pm Pacific time for SF-based teams”

- “Developers adjust schedules to attend your standups.”

- “We staff specifically for your timezone, not ours.”

Red flag (0 points):

- “We’re flexible and adapt to client needs” without specific hours

Question 3: “Walk me through a typical week of communication. What does Monday morning look like?”

Good answer (2 points):

- Detailed schedule including daily standup times

- Async update cadence specified

- Sprint planning structure outlined

- Emergency protocols defined

Red flag (0 points):

- “We’ll figure it out based on your preferences.”

Question 4: “How do you handle urgent issues outside overlap hours?”

Good answer (2 points):

- “On-call rotation with 2-hour SLA for critical issues”

- “Cell phone access to tech leads”

- “Escalation to senior developers if needed”

Red flag (0 points):

- “We respond within 24 hours.”

Question 5: “Show me an example Slack channel or communication log from a current client.”

Good answer (2 points):

- Provides a redacted but real example

- Shows message frequency and response times

- Demonstrates communication quality

Red flag (0 points):

- “We can’t share due to NDAs,” without offering any proof

Category minimum: 8/10 points

The data is clear: direct communication saves time and prevents costly mistakes. Now, let’s look at how vendors should be vetting the developers they present to you.

Category 2: Quality & Vetting Process

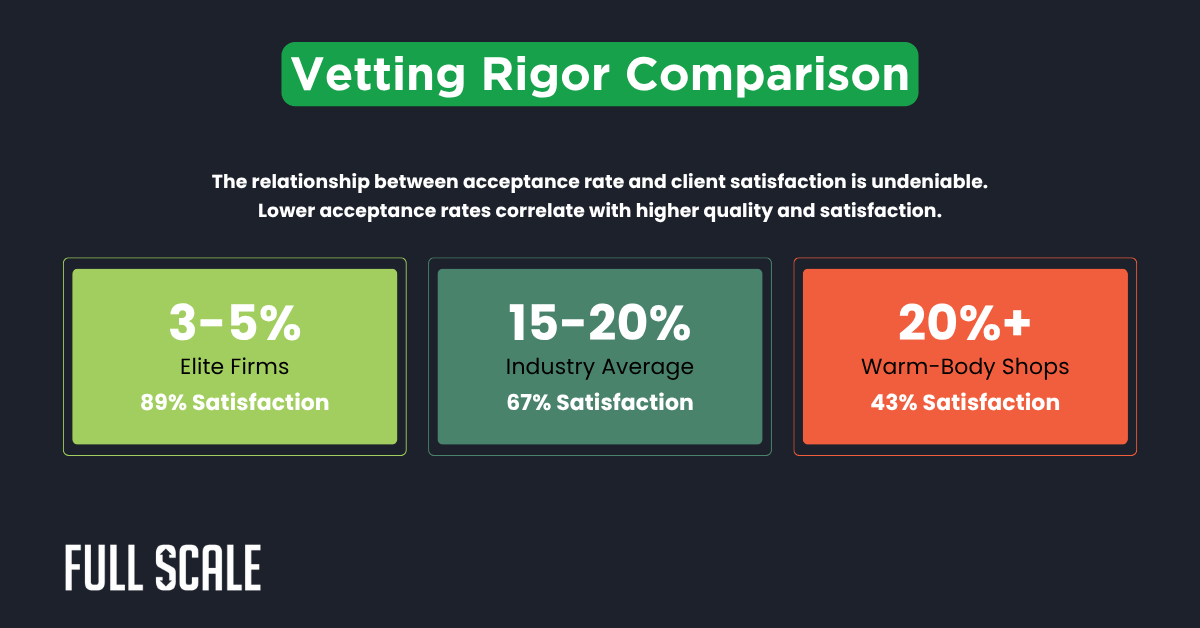

Developer quality starts with brutal vetting. The best offshore companies reject 95% of applicants. Warm-body shops hire anyone with a pulse and a resume.

How to vet offshore software companies comes down to one number: acceptance rate. If they’re hiring more than 20% of applicants, quality issues are guaranteed. This is the fastest way to separate elite firms from the rest.

Question 6: “What’s your developer acceptance rate? Out of 100 applicants, how many make it through?”

Why this matters: Top firms hit 3-5% acceptance rates. Industry average is 15-20%.

Good answer (2 points):

- “Our acceptance rate is 3-5%”

- “Last month: 300 applications, 12 hired”

- “Here’s our funnel breakdown with specific numbers.”

Red flag (0 points):

- Doesn’t track this metric

- Refuses to share data

- Rate exceeds 20%

Score: Dealbreaker if the acceptance rate is above 20% or they won’t share data.

Gartner’s 2024 research shows that companies with acceptance rates below 10% have 89% client satisfaction. Above 20% drops to 43% satisfaction.

Question 7: “Walk me through your technical vetting process step-by-step.”

Good answer (2 points):

- Resume screen with specific criteria

- Live coding assessment (not multiple choice)

- Architectural discussion with system design

- Cultural fit interview

- Reference checks with previous employers

Red flag (0 points):

- “We verify resumes and conduct interviews” (too generic)

Question 8: “Can I interview the actual developers before committing?”

Good answer (2 points):

- “Yes, you interview and approve every developer.”

- “You have full veto power before they start.”

Red flag (0 points):

- “We pre-select the best fit for you” (no client veto power)

Score: Dealbreaker if you can’t interview developers first.

This one’s non-negotiable. If they won’t let you talk to developers, they know those developers won’t impress you.

Run.

Question 9: “What happens if a developer doesn’t meet expectations after 30 days?”

Good answer (2 points):

- “Free replacement within 2 weeks”

- “No penalty or fees”

- “We eat the cost of the mismatch.”

Red flag (0 points):

- “We stand behind our vetting,” without a concrete guarantee

Question 10: “Show me a sample technical assessment you give candidates.”

Good answer (2 points):

- Provides an actual coding challenge

- Shows an architectural problem or a system design question

- Demonstrates practical assessment, not theory

Red flag (0 points):

- “It’s proprietary” or shows a multiple-choice quiz

Category minimum: 8/10 points

Quality vetting is just the start. The real test is whether developers stick around long enough to deliver value.

Category 3: Retention & Team Stability

Developer turnover kills offshore partnerships. You spend 3 months ramping someone up, they quit, you start over. Industry average retention is 60-70% annually, according to Stack Overflow’s 2024 Developer Survey.

Elite offshore development partner companies hit 90-95% retention. They treat developers like valued employees, not disposable contractors. Ask these offshore software vendor questions to separate sustainable partnerships from revolving doors.

Question 11: “What’s your actual developer retention rate, and how do you calculate it?”

Why this matters: Anyone can claim “high retention.” The calculation methodology reveals the truth.

Good answer (2 points):

- “95% annual retention rate”

- “We measure developers staying 12+ months with the same client.”

- “Last year: 342 of 360 developers renewed”

Red flag (0 points):

- “Very high” or “industry-leading” without specific numbers

Score: Dealbreaker if retention is below 80% or they won’t share actual data.

I’ve asked this question to 50+ vendors. Half don’t track it.

Another 30% lie. The 20% who answer honestly with data are the only ones worth considering.

Question 12: “What’s the average tenure of developers currently working for clients?”

Good answer (2 points):

- “Average tenure is 2.5 years.”

- “40% of our developers have been with clients 3+ years”

- “Our longest placement is 6 years.”

Red flag (0 points):

- “Most developers stay long-term” without specific averages

Question 13: “What benefits and career growth do you provide developers?”

Good answer (2 points):

- Competitive local salary plus benefits

- Annual training budget per developer

- Clear career ladder with advancement criteria

- Performance bonuses tied to client satisfaction

Red flag (0 points):

- “Competitive compensation” without specifics

Question 14: “What’s your backup plan if my lead developer leaves suddenly?”

Good answer (2 points):

- “Every client has a shadow developer who ramps up over 3-6 months.”

- “They attend key meetings and review PRs.”

- “Transition takes 1-2 weeks maximum.”

Red flag (0 points):

- “We’ll find a replacement quickly,” without the existing contingency

Category minimum: 6/8 points

| Retention Metric | Industry Average | Top 10% Firms | Your Target |

|---|---|---|---|

| Annual Retention Rate | 60-70% | 90-95% | ≥80% |

| Average Developer Tenure | 14 months | 30+ months | ≥24 months |

| Developers with 3+ Year Tenure | 15% | 40% | ≥30% |

| Client Satisfaction Rate | 43% | 89% | ≥75% |

High retention means developers are happy and clients are satisfied. But none of that matters if the contract terms and pricing hide surprises.

Category 4: Pricing & Contract Terms

Hidden fees and contract traps destroy offshore ROI. You think you’re saving 60% on development costs in San Francisco or Austin. Then you discover fees for equipment, training, replacement, and “project management overhead.”

Offshore outsourcing red flags always show up in pricing discussions. Watch for vendors who get vague or defensive. Transparent companies itemize everything upfront and put it in writing.

Question 15: “Break down your pricing: what’s included and what costs extra?”

Why this matters: Uncovers hidden fees that inflate actual costs by 20-40%.

Good answer (2 points):

- “Monthly rate of $5,500 per developer includes full salary, benefits, equipment, workspace, and operational overhead”

- “Only extra cost: software licenses you specifically need”

- Provides an itemized breakdown

Red flag (0 points):

- “All-inclusive pricing” without itemization

Learn more about our transparent pricing model.

Question 16: “What’s your minimum commitment—contract length, team size, hours?”

Good answer (2 points):

- “Month-to-month contracts after first 3 months”

- “No minimum team size”

- “Scale up or down with 2-week notice”

Red flag (0 points):

- “6-month minimum with 90-day cancellation notice”

Long contracts mean they know their quality is questionable. Confident vendors let you cancel anytime because they know you won’t want to.

Learn more about flexible staff augmentation models versus rigid outsourcing contracts.

Question 17: “Who owns the code and IP? Where is this documented?”

Good answer (2 points):

- “You own 100% of all IP created.”

- “Our U.S.-based master services agreement specifies work-for-hire”

- “Here’s the exact contract clause.”

Red flag (0 points):

- “Standard IP assignment” without showing actual contract language

Score: Dealbreaker if IP ownership isn’t clear, exclusive to you, and documented in a U.S. contract.

This killed a $20M acquisition deal I know about. The buyer discovered that the offshore vendor retained partial IP rights.

Deal died. Don’t let this be you.

Question 18: “What happens if I want to hire the developer full-time?”

Good answer (2 points):

- “You can hire developers directly anytime.”

- “One-time buyout fee equal to 3 months of billing”

- “Then they’re yours permanently.”

Red flag (0 points):

- “Developers cannot be hired directly,” or buyout fees exceeding 6 months

Category minimum: 7/8 points

True Cost Calculator

Calculate the real cost difference between hiring locally in major tech hubs versus using offshore development.

Clear pricing and contract terms set expectations. But the real operational test is whether vendors adapt to your existing processes or force you into theirs.

Category 5: Integration & Workflow

Process integration determines if offshore developers feel like your team or a separate vendor. The best partnerships adapt completely to your workflow.

Bad ones force you into their system. These questions to ask offshore development companies reveal whether they’re flexible partners or rigid vendors with a “our way or the highway” mentality.

Question 19: “Do developers adapt to our process, or do we adapt to yours?”

Good answer (2 points):

- “Developers follow your process 100%”

- “Your tools, ceremonies, coding standards, PR review process”

- “They integrate like in-house hires.”

Red flag (0 points):

- “We have a proven Agile process we recommend all clients follow.”

Question 20: “What project management and communication tools do you require us to use?”

Good answer (2 points):

- “Zero requirements”

- “We use whatever you use—Jira, Linear, Asana, Slack, Teams, whatever”

- “Developers already have accounts.”

Red flag (0 points):

- Requires specific tools or platforms

Question 21: “How do you handle code reviews, PRs, and QA in our existing pipeline?”

Good answer (2 points):

- “Developers submit PRs directly to your repos.”

- “They follow your branching strategy.”

- “Participate in your code review process exactly like local developers.”

Red flag (0 points):

- “We maintain separate development repos that we merge periodically.”

Separate repos mean you don’t have visibility into daily work. You only see finished chunks.

That’s not integration. That’s outsourcing with extra steps. Learn the difference in our guide to how offshore development works.

Question 22: “Can developers attend our daily standups, sprint planning, and retros?”

Good answer (2 points):

- “Yes, they’re required to attend all team ceremonies within overlap hours.”

- “They’re full team members.”

Red flag (0 points):

- “They provide async updates instead to avoid meeting overhead.”

Question 23: “What’s your onboarding process for integrating with our codebase?”

Good answer (2 points):

- Week 1: Environment setup and codebase review

- Week 2: Small PRs for learning

- Week 3: Regular velocity

- Assigned an onboarding buddy from the existing team

Red flag (0 points):

- “Usually takes a few weeks to get up to speed” (no structure)

Category minimum: 8/10 points

Process integration is technical. But the final category—cultural fit—determines whether the partnership actually works long-term.

Category 6: Cultural Fit & Values

Technical skills matter. Cultural alignment matters more.

Mismatched values create friction that destroys long-term partnerships. Great developers who don’t fit your culture will leave or create team dysfunction.

Smart CTOs evaluate culture as rigorously as code quality when they evaluate offshore development vendors. These questions reveal whether vendors prioritize developer experience or just warehouse bodies for profit.

Question 24: “How do you ensure cultural alignment between developers and client teams?”

Good answer (2 points):

- “Culture assessment is part of our vetting process.”

- “You define your team values and working style”

- “We screen developers for fit before introduction.”

Red flag (0 points):

- “Our developers are professionals who adapt to any culture” (no screening)

Question 25: “Walk me through how you handled a difficult situation with a client.”

Good answer (2 points):

- Specific example including the conflict

- Their resolution approach

- Outcome with lessons learned

Red flag (0 points):

- “We rarely have issues” is a generic response

This question reveals more than any marketing pitch. How they handle problems tells you who they really are.

Question 26: “What are your company values, and how do they show up in daily work?”

Good answer (2 points):

- List 3-5 specific values

- Concrete examples of how values manifest in operations

- Links to hiring, client relationships, and developer treatment

Red flag (0 points):

- Generic values like “integrity, excellence, innovation” without examples

Question 27: “How do you support developers’ professional growth and learning?”

Good answer (2 points):

- Annual training budget per developer with specific amounts

- Conference attendance policy

- Certification reimbursement

- Internal tech talks or learning sessions

Red flag (0 points):

- “Developers learn on the job through challenging projects” (no formal support)

Category minimum: 6/8 points

You’ve now covered all 27 questions across the 6 categories. But before you score vendors, you need to know about three answers that end the conversation immediately—regardless of how well they scored everywhere else.

The 3 Automatic Dealbreakers

Some answers end the conversation immediately. Doesn’t matter if they scored perfectly on everything else. These are partnership killers that guarantee failure.

Vendors hope you don’t ask question #14 about backup plans. Ask it anyway. Their answer might save you $200K and 6 months of pain.

⚠️ Three Non-Negotiable Dealbreakers

1. No Direct Developer Access

If they insist on PM gatekeepers, stop the evaluation. The telephone game destroys offshore partnerships faster than anything else. You tell the PM what you need, PM tells developers, developers build something different. Three months later you discover the product is wrong.

2. Unclear IP Ownership

If they won't show clean IP assignment in a U.S. contract, walk away. Your investors will demand clean IP before funding rounds. Acquirers will kill deals over this. I've seen companies lose $20M+ acquisition opportunities because their offshore vendor retained partial IP rights.

3. Developer Acceptance Rate Above 20%

If they're hiring more than 1 in 5 applicants, quality is impossible. You can't maintain high quality while hiring 20%+ of applicants. Elite talent is rare. Top firms reject 95 out of 100 candidates.

IF No direct developer access → END EVALUATION

OR IF IP ownership unclear/shared → END EVALUATION

OR IF Acceptance rate >20% → END EVALUATION

I've ignored these dealbreakers twice. Cost me $400K total. Don't be me.

Now that you know what disqualifies a vendor instantly, let’s look at how to interpret the scores for vendors who pass the dealbreaker test.

Scoring Interpretation: What Your Results Mean

You’ve scored the vendor across all 6 categories. Total possible points: 54. Now, interpret what those numbers actually mean for partnership viability.

Most vendors fail this evaluation. That’s the point. This framework filters out risky offshore outsourcing red flags before they become expensive problems—costing you 6 months and $200K.

| Score Range | Verdict | Action |

|---|---|---|

| 50-54 (93-100%) | ✅ EXCELLENT | All categories exceed minimums. Zero red flags. Proceed to contract negotiation. |

| 43-49 (80-92%) | ✅ GOOD | Most categories strong. Request detailed references before proceeding. |

| 38-42 (70-79%) | ⚠️ MARGINAL | Multiple red flags. Only proceed if they address ALL concerns in writing. |

| Below 38 (<70%) | ❌ FAIL | Too many red flags. Continue your search for better-qualified vendors. |

Critical reminder: Any category scoring below its specific minimum is an automatic fail, regardless of total score. You can’t compensate for terrible communication with great pricing. You can’t offset questionable retention with perfect integration.

After evaluating multiple vendors with this framework, you’ll see clear differences. The best partners score consistently high across all categories. If you’re wondering how Full Scale measures up, here’s our approach.

Why Partner with Full Scale

We built Full Scale after experiencing every offshore horror story firsthand. Here’s why we pass our own 27-question framework:

- Direct Developer Access — Your developers report to you, not to us. Direct Slack/email access, no PM gatekeepers.

- 95% Retention Rate — Industry average is 60-70%. We treat developers as valued employees with full benefits and career growth.

- 3-5% Acceptance Rate — We reject 95 out of 100 applicants. Multi-stage technical vetting with live coding assessments.

- Month-to-Month Contracts — No long-term lock-in. Scale up or down with a 2-week notice after the initial 3 months.

- 100% IP Ownership — U.S.-based contracts with clear work-for-hire language. You own every line of code.

- Your Process, Your Tools — Developers adapt completely to your workflow. Use your repos, ceremonies, and tools.

Discover more about our approach and why companies choose Full Scale, or learn how our vetting process works.

See how we answer all 27!

Ask 27 questions across 6 categories: Team Structure (direct access, timezone), Quality Vetting (acceptance rate, technical assessment), Retention (turnover, backup plans), Pricing (fees, IP ownership), Integration (process fit, tools), and Cultural Fit (values, growth). Score answers 0-2 points. Companies must score 80%+ with all category minimums met to pass offshore vendor due diligence.

Use a structured 90-minute interview with a scoring framework. Award 2 points for data-backed answers, 1 for acceptable, 0 for red flags. Category minimums: Team Structure 8/10, Quality 8/10, Retention 6/8, Pricing 7/8, Integration 8/10, Cultural Fit 6/8. Total must exceed 80%. Three dealbreakers automatically disqualify: no direct developer access, unclear IP ownership, or an acceptance rate above 20%.

Three automatic dealbreakers end evaluations: requiring PM gatekeepers instead of direct developer access, unclear or shared IP ownership that creates legal risks, and developer acceptance rates above 20% indicating poor quality control. Other major red flags include retention below 80%, contract minimums exceeding 3 months, vague answers without data, inability to show technical assessments, and refusal to allow client interviews with developers.

First contracts should not exceed 3 months. Top offshore partners offer month-to-month contracts after the initial period, showing confidence in the quality. Long commitments (6+ months) indicate vendors lack confidence or use lock-in for high churn. After proving value in 3 months, flexible scaling with a 2-week notice is standard. Avoid contracts requiring 90+ day cancellation notice.

Top 10% of offshore firms achieve 90-95% annual retention versus 60-70% industry average. Anything below 80% is concerning. Good vendors measure retention as developers staying 12+ months with the same client. Elite firms show 40%+ of developers with clients for 3+ years. Gartner research shows 89% satisfaction with high-retention vendors versus 43% with high-turnover vendors.