The Developer Hiring Trends 2026: Crisis Starts in January. Here s How to Avoid It

What You'll Learn in This Guide

- Why 2026 will be 40% harder than 2025 for tech hiring

- The December 15 deadline most CTOs don't know about

- Three hiring models compared with real cost and timeline data

- Week-by-week action plan for Q4 2025 preparation

- Calculate your specific advantage of acting now vs. waiting

- Why offshore development suddenly makes sense for 2026

Will There Be a Developer Shortage in 2026?

Yes. The software developer shortage in 2026 will be 40% more severe than in 2025 due to three converging factors:

- AI-driven demand requires 3X more ML engineers than currently exist

- Senior engineer retirements remove 18% of experienced developers from the workforce

- H-1B visa restrictions reduce the available talent pool by 15%

The hiring window closes December 15, 2025. Top developers commit during Q4 budget cycles. Companies preparing now gain 6-9 months of advantage over January starters.

Looking at developer hiring trends 2026, the data reveals an uncomfortable truth. Most CTOs think January 2026 is when hiring gets hard. They’re already three months too late.

The Data Behind the Tech Hiring Crisis 2026

The numbers tell a story most engineering leaders haven’t processed yet. We’re not facing another tight market. We’re staring down a structural shift in talent allocation.

Stack Overflow’s 2024 Developer Survey shows that 67% of senior engineers receive multiple offers before posting resumes. LinkedIn’s 2024 Tech Talent Report reveals companies now compete for candidates who aren’t actively looking. The developer talent shortage isn’t about finding people who want jobs. It’s about convincing employed developers to switch.

Here’s what the comparison actually looks like:

| Hiring Metric | 2025 Reality | 2026 Forecast | Change |

|---|---|---|---|

| Average Time-to-Hire | 65 days | 95 days | +46% |

| Developer Shortage | 1.4M roles | 2.0M roles | +43% |

| Senior Dev Salary | $165K avg | $235K avg | +42% |

| Offshore Adoption | 32% | 58% | +81% |

| Offer Acceptance | 73% | 51% | -30% |

This table shows the future of tech hiring compressed into five metrics. Every number moves wrong for companies relying on traditional local hiring. The software engineering talent war isn’t coming. It’s here, and 2026 amplifies every pressure point.

Three Forces Colliding in 2026

The CTO hiring strategy 2026 requires understanding why this year differs from every previous cycle. Three separate trends converge simultaneously.

The AI Demand Explosion

Every company needs AI capabilities yesterday. Enterprise adoption reports show 78% of Fortune 500 companies initiated AI projects in 2025. These aren’t small experiments. They’re full platform integrations requiring specialized talent.

The problem? Universities produce 65,000 CS graduates annually. The market demands 180,000 AI-capable engineers. That 115,000-person gap grows wider daily.

I watched one client lose three months trying to hire a senior ML engineer locally. They interviewed 47 candidates. Made offers to five. Got zero acceptances.

The Great Developer Retirement Wave

Baby boomers are retiring. They’re taking 20 years of expertise with them. Bureau of Labor Statistics data shows 18% of senior developers born 1970-1980 plan retirement before 2027.

These aren’t junior developers. They’re principal engineers and architects. One principal leaving takes institutional knowledge with them. Replacing them requires hiring two senior developers minimum. Those people don’t exist in sufficient quantities.

Immigration Policy Tightening

H-1B visa caps dropped 15% for tech roles in 2025. That removes 45,000 potential developers from the U.S. hiring pool annually. Canada, the UK, and European countries compete more aggressively for international talent.

The developer hiring forecast 2026 shows this trend accelerating. Political pressures make visa expansion unlikely.

What Most CTOs Miss About Timing

Here’s the part that keeps me up at night. The window to prepare for 2026 isn’t January. It’s right now, this quarter.

Most engineering leaders think, “We’ll start recruiting in January when budgets are approved.” The market reality is that top developers get locked in during November-December.

Let me share a specific example. One of our SaaS clients needed to scale from eight to twenty developers by Q2 2026. They started planning in September 2025.

By December 15, they had commitments from twelve developers starting in January and February. Their competitors started recruiting in early January. They spent the entire first quarter competing for diminishing talent pools.

Our client shipped their major product update in March. Competitors were still interviewing. The difference? Three months of planning time delivered a six-month execution advantage.

The Real Cost of Waiting Until January

Let’s talk about what delay actually costs. The software engineer demand 2026 creates specific, measurable penalties for late movers.

Salary Inflation Acceleration

Developers interviewing in January know they’re in demand. They leverage multiple offers against each other. Compensation goes up 25-40% above November rates.

You’re not competing on skills. You’re competing in a bidding war with every other company that waited. Local market competition forces you to match these inflated rates.

Once you set a salary precedent with one hire, you’ve established a new baseline. Your entire compensation structure adjusts upward.

Extended Time-to-Productivity

Hiring in Q1 means onboarding in Q1 or Q2. New developers need 2-3 months to become productive. That pushes meaningful contribution to Q2 or Q3.

You effectively lose half your year to recruitment delays. Compare this to developers starting in January who are productive by March. They contribute to Q1 goals. They influence Q2 planning. Learn more about effective onboarding strategies.

Project Roadmap Delays

The cascade effect hits hardest here. One delayed hire pushes back feature releases. Those delays impact customer commitments and competitive positioning.

I’ve watched companies lose entire market opportunities because they couldn’t ship fast enough. One client missed their window to launch before a major competitor. The market lead they wanted became a follower position. They’re still trying to escape eighteen months later.

Interactive Timeline: Your 2026 Hiring Journey

Compare what happens when you start in Q4 2025 versus waiting until Q1 2026. This timeline shows the real difference in outcomes based on timing decisions.

Understanding how to prepare for a developer shortage requires visualizing different scenarios. See exactly what each timeline delivers.

This timeline demonstrates why when to start hiring developers 2026 matters more than most CTOs realize. The three-month head start creates a six-month execution advantage.

Understanding the 2026 Hiring Models

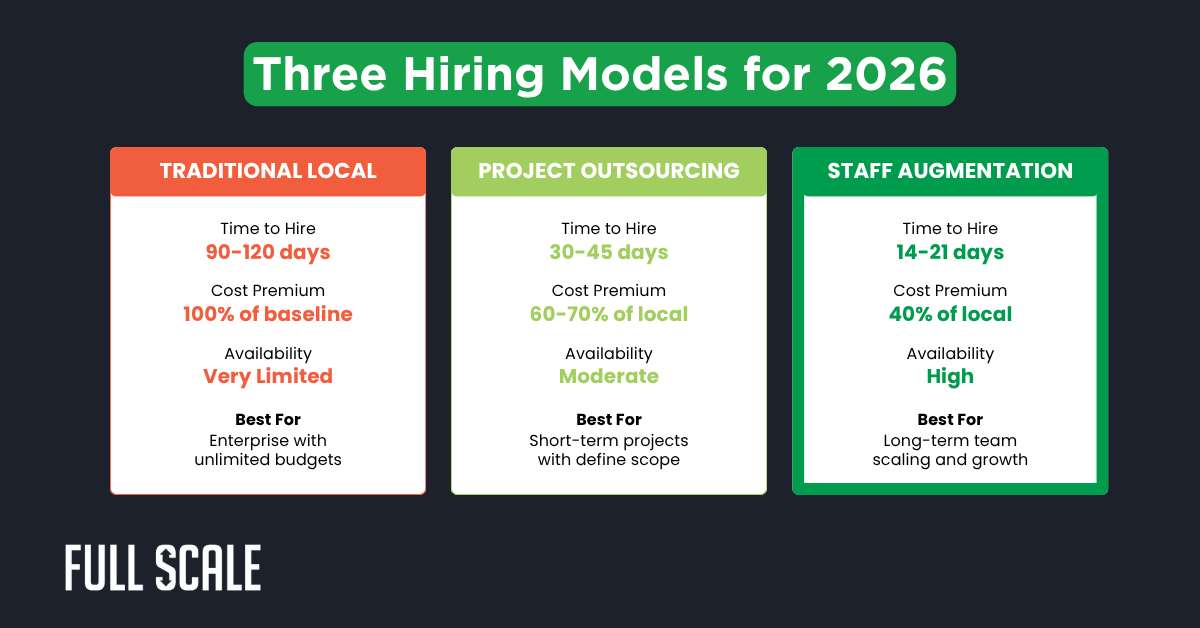

Not all hiring models work for 2026. Pick wrong and you’ll waste six months and six figures. Let me break down three models and show you which situation fits each approach.

This comparison shows why the future of tech hiring tilts heavily toward staff augmentation. Traditional local hiring can’t meet 2026 demand at sustainable costs. Project outsourcing creates communication barriers.

Staff augmentation solves the 2026 problem by combining speed, cost efficiency, and team integration. Developers work directly with your team. They attend your standups, use your Slack channels, and integrate into your processes. Explore staff augmentation benefits.

Calculate Your 2026 Hiring Advantage

See exactly what early action delivers for your specific situation. This calculator shows the competitive advantage of moving now versus waiting until January.

Q4 2025 Preparation ROI Calculator

Your 2026 Hiring Advantage:

This calculator uses real market data from our 60+ client engagements over the past three years. The numbers reflect actual hiring timelines, salary inflation rates, and productivity ramp-up periods.

Why Offshore Development Suddenly Makes Sense

Here’s something controversial: by 2026, refusing offshore becomes professional negligence. The math doesn’t work for pure local hiring anymore.

Let me explain with a specific example. Three years ago, one of our clients insisted on local-only hiring. They spent nine months trying to hire four senior developers.

The first hire took four months and cost $195K. Well above their budgeted $160K. The second hire accepted another offer two days before their start date. The third candidate failed their background check. The fourth hire lasted six weeks.

Nine months, hundreds of hours of leadership time. They had one developer who wasn’t quite the right fit. Their product roadmap fell six months behind. Customers churned. Investors asked hard questions.

They finally agreed to try staff augmentation. We placed four senior developers in three weeks. All four are still with them eighteen months later.

Their engineering team grew from eight to twenty-two people. They shipped more features in Q2 2026 than all of 2025 combined. The offshore vs. local developer debate isn’t about quality anymore. It’s about availability and economic reality. Read about offshore development success stories.

The Direct Integration Model That Actually Works

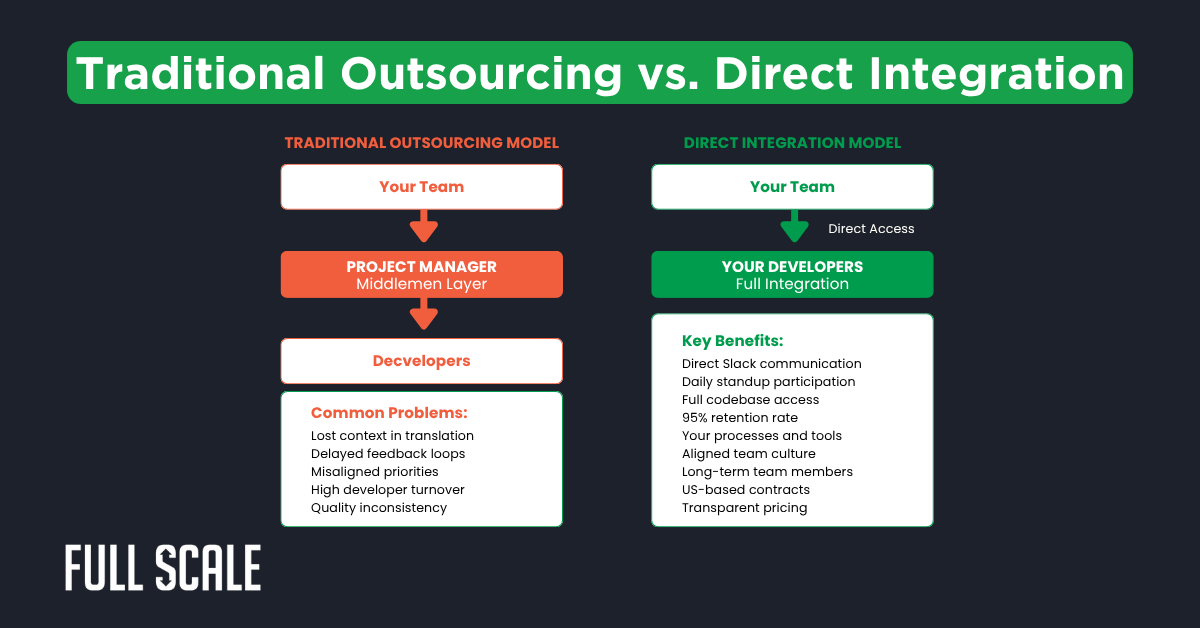

Not all offshore development delivers the same results. Traditional outsourcing creates the problems most CTOs fear. Communication breakdowns. Misaligned incentives. Quality issues.

This diagram shows why the direct integration model solves 2026’s hiring challenges. Traditional outsourcing adds layers between you and developers. Every layer creates friction. Direct integration removes those barriers completely.

Your offshore developers become your team members in every meaningful way. They attend your meetings, use your tools, follow your processes. The only difference is location and payroll provider.

We’ve refined this model over eight years and 500+ developer placements. Our 95% retention rate comes from treating developers as long-term team members. Not disposable contractors. Learn how to build successful remote teams.

Why Partner with Full Scale

We’ve spent eight years fixing what’s broken about offshore development. Our staff augmentation model works because we learned from every failure point in traditional outsourcing.

Direct developer integration without middlemen

Your developers join your Slack, attend your standups, and work directly with your team. No project managers are translating requirements.

95% developer retention over three years

We treat developers as long-term career professionals. They receive competitive compensation, professional development, and clear growth paths.

US-based contracts with transparent pricing

Your contract is with Full Scale, a US company. This protects your IP and simplifies legal compliance. No hidden fees.

Rigorous vetting process for senior developers

Every developer passes technical assessments, code reviews, and cultural fit evaluations. We reject 95% of applicants.

Two-week placement timeline average

We maintain a ready pipeline of pre-vetted developers in major tech stacks. This delivers 14-21-day placements instead of 90-120-day cycles.

Full team integration support

We provide onboarding frameworks, communication best practices, and ongoing integration support. Your success determines ours.

Flexible month-to-month agreements

No long-term contracts required. Scale your team up or down based on actual needs.

Start Your 2026 Preparation Today

The 2026 developer shortage won’t wait for you to feel ready. Companies that prepare now gain months of competitive advantage. The window to act closes faster than most CTOs realize.

You have two choices. Start building your 2026 team this quarter or compete for scraps in January’s talent war.

Ready to Avoid the 2026 Crisis?

Book a 15-minute strategy call to discuss your 2026 hiring needs. No obligation, just a conversation about what’s possible when you act early.

Start planning in Q4 2025 for maximum advantage. Budget approvals, partner evaluation, and candidate sourcing all take time. Companies beginning in November or December secure better candidates at lower costs. The best developers make commitments during year-end planning cycles.

Three factors converge simultaneously in 2026. AI-driven demand requires 3X more specialized engineers. Senior developer retirements are removing 18% of experienced talent. Immigration restrictions are reducing the available pool by 15%. Previous shortages involved one or two factors. This perfect storm creates unprecedented competition.

Present the cost data. Waiting until January increases salaries 42%, extends hiring timelines 46%, and delays productivity by a full quarter. Show the calculator results from this article. Frame early action as risk reduction. The riskiest move is waiting while competitors secure talent first.

Offshore development through proper staff augmentation uses US-based contracts. These protect your intellectual property the same way local employment does. Choose partners who offer US contracts, background-checked developers, and clear IP assignment terms. Our contracts include comprehensive IP protection and NDA provisions.

Quality staff augmentation partners place developers in 14-21 days on average. This timeline includes technical assessments, interviews, and contract finalization. Traditional local hiring takes 90-120 days for comparison. The speed advantage comes from pre-vetted developer pipelines.