Most CTOs think offshore development is about finding cheap talent in the Philippines. They are wrong.

It’s about navigating a legal minefield where one wrong step costs more than US salaries.

We watched a client learn this the hard way. Fast-growing SaaS company, Series B funding, aggressive growth targets. They hired 15 developers across India, the Philippines, and Ukraine in six months. Smart move for scaling—until the compliance audit hit.

The damage: $340K in misclassification penalties, six months of legal cleanup, and a compliance framework that cost more than two senior US developers.

The problem wasn’t their offshore teams. The developers were excellent.

The problem was treating global teams like local teams with different zip codes.

The Real Cost of Getting Global Compliance Wrong

Here’s what nobody tells you about global remote team management compliance: 78% of multinational companies faced compliance challenges in 2024. That’s not bad luck—that’s predictable failure.

The financial reality:

- Employment misclassification: $50K-$500K per developer

- GDPR violations: €20M or 4% of annual revenue

- Permanent establishment tax hits: 25-30% corporate tax on all local activities

- Cultural integration failures: 60% of offshore projects fail due to poor cultural fit

But here’s the part that really hurts: Most of these disasters are completely preventable.

Why Traditional Global Remote Team Management Compliance Fails

The biggest offshore disasters aren’t caused by bad developers. They’re caused by companies that think they can manage global teams like local ones without proper global remote team management compliance.

- Wrong approach: “Let’s hire contractors in the Philippines and manage them like our downtown team.”

- Right approach: “Let’s build a global remote team management compliance framework that makes offshore development safer than local hiring.”

After helping 60+ companies scale globally, we’ve learned this: Global development isn’t about finding talent—it’s about building legal and cultural bridges.

For companies looking to build offshore development teams effectively, understanding this distinction is crucial.

The Five-Layer Global Remote Team Management Compliance Framework

Every successful global development operation operates on five critical compliance layers. Miss any layer, and the whole structure collapses.

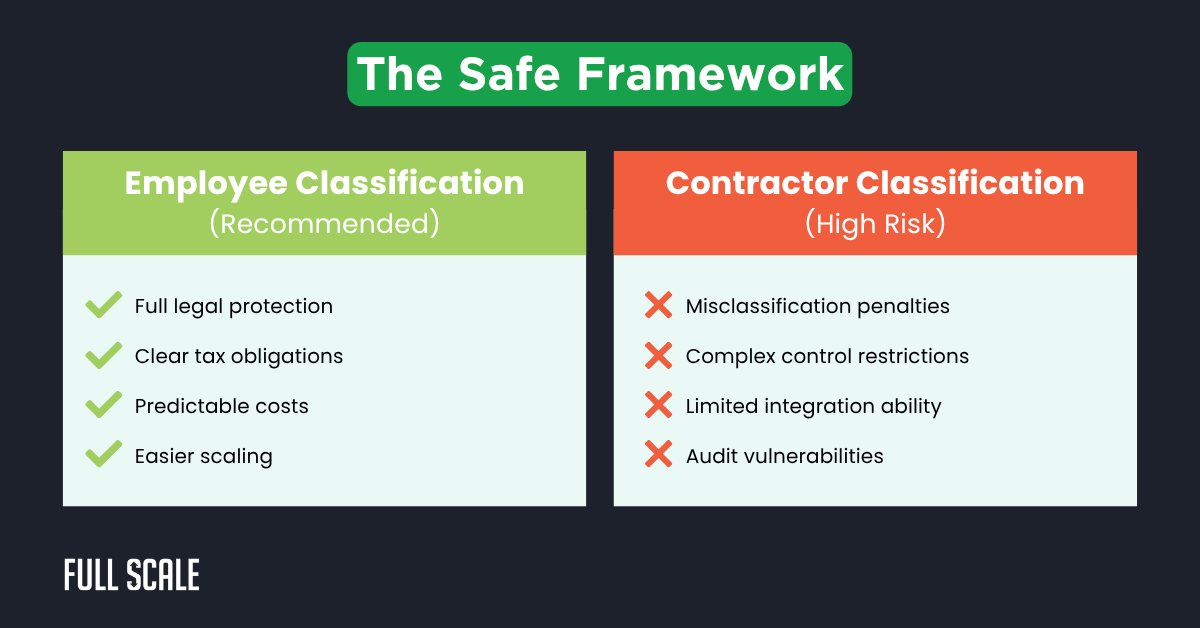

Layer 1: Employment Classification (The $500K Mistake)

The Philippines Reality Check: The Philippines’ labor law is employee-friendly. Very employee-friendly. If you provide equipment, set schedules, or require daily check-ins, you’re probably dealing with employees, not contractors.

The Philippines Department of Labor and Employment (DOLE) has specific guidelines that many companies overlook until it’s too late.

Classification Tests That Matter

- Control Test: Do you dictate how, when, and where work gets done?

- Economic Reality Test: Are they economically dependent on you?

- Integration Test: Are they essential to your business operations?

Real Example: We helped a client who hired “contractors” in Manila. They provided laptops, required 9 AM standups, and tracked time in Jira. The Philippines Department of Labor ruled them employees.

Cost: $180K in back taxes and penalties.

The Safe Framework

Layer 2: Data Protection (The GDPR Nightmare)

Cross-Border Data Reality: Your Philippine developers will access client data, code repositories, and internal systems. That’s cross-border data transfer—and it’s regulated.

Understanding global remote team management compliance for data protection is essential for any company working with EU clients.

Philippines Data Privacy Act + GDPR Requirements

- Consent mechanisms for employee data processing

- Data Processing Agreements with all offshore partners

- Cross-border transfer safeguards for EU client data

- Breach notification procedures within 72 hours

The Philippines National Privacy Commission provides comprehensive guidelines for data protection compliance.

The Protection Framework

- Data mapping: Know what data goes where and why

- Legal basis documentation: Have clear grounds for every transfer

- Vendor agreements: Ensure offshore partners have proper DPAs

- Regular audits: Review data flows quarterly

Technical Implementation

- VPN-only access to production systems

- Role-based access controls

- Data encryption at rest and in transit

- Activity logging and monitoring

Layer 3: Tax Compliance (The Permanent Establishment Trap)

Philippines Tax Trap: Regular business activities conducted through Philippine employees can create a permanent establishment. That subjects you to 32% corporate tax on Philippines-sourced income.

The Philippines Bureau of Internal Revenue (BIR) has strict guidelines on what constitutes permanent establishment for foreign companies.

PE Triggers to Avoid

- Fixed place of business (including home offices)

- Authority to conclude contracts

- Storage facilities or equipment

- Regular business activities beyond support functions

Safe Harbor Strategies

- Use staff augmentation models where developers remain employees of the Philippines partners

- Limit the decision-making authority of the Philippines’ staff

- Avoid establishing fixed business locations

- Keep activities to support functions only

Tax Compliance Checklist

- Philippines BIR registration (if required)

- Withholding tax on payments (varies by tax treaty)

- VAT registration for certain services

- Annual tax return filings

Layer 4: Cultural Integration (The 60% Failure Rate)

Philippines Communication Culture: Filipinos value harmony and face-saving. “Yes” doesn’t always mean “I understand and agree”—it often means “I don’t want to disappoint you.”

For deeper insights into managing cultural differences in offshore teams, understanding these nuances is critical.

Cultural Challenges That Kill Projects

- Indirect communication: Problems aren’t directly stated

- Hierarchy respect: Junior developers won’t challenge senior decisions

- Conflict avoidance: Issues fester instead of being addressed

- Time flexibility: “Flexible deadlines” interpreted as suggestions

Research shows that 60% of offshore projects fail due to cultural misalignment, making cultural integration a business-critical skill.

The Cultural Bridge Framework

Communication Protocols

- Daily written status updates (not just verbal)

- Weekly one-on-ones for relationship building

- Monthly cultural check-ins to address issues

- Quarterly team integration sessions

Feedback Delivery System

- Private feedback sessions (never public criticism)

- Specific, actionable feedback (not general comments)

- Positive reinforcement for question-asking

- Cultural mentoring pairs

Performance Management

- Clear written expectations and success metrics

- Regular recognition for achievements

- Career development conversations

- Cultural sensitivity training for US managers

Quality Control and Performance Measurement Framework

The Remote Performance Challenge: You can’t manage what you can’t measure. But traditional productivity metrics fail with offshore teams because they don’t account for cultural differences and time zone coordination.

Cultural-Appropriate KPI Setting

Technical Metrics (40% of performance)

- Code quality scores (complexity, maintainability, test coverage)

- Bug detection rates per 1000 lines of code

- Pull request approval times

- Documentation completeness scores

Collaboration Metrics (35% of performance)

- Response time to messages (within cultural expectations)

- Meeting participation and preparation quality

- Knowledge sharing contributions

- Cross-team integration effectiveness

Delivery Metrics (25% of performance)

- Story point completion rates (adjusted for cultural context)

- Sprint commitment reliability

- Time-to-delivery improvements

- Client satisfaction scores

Philippines-Specific Performance Considerations

- Face-saving culture: Private feedback sessions, not public scorecards

- Relationship focus: Team collaboration is weighted higher than individual output

- Indirect communication: Regular one-on-ones to surface issues

- Hierarchy respect: Senior developers mentor, don’t compete with junior staff

Quality Assurance Standards

- Code Review Requirements: Minimum two reviewers, one must be senior

- Testing Protocols: Unit test coverage minimum 80%, integration tests required

- Documentation Standards: All functions documented, architecture decisions recorded

- Security Checks: Automated vulnerability scanning, manual security reviews

Performance Monitoring Tools

- Productivity: GitLab/GitHub analytics for code contribution metrics

- Communication: Slack analytics for response times and engagement

- Quality: SonarQube for code quality, Jira for delivery tracking

- Cultural Integration: Regular pulse surveys on team satisfaction and cultural alignment

Layer 5: Operational Excellence (The 24/7 Advantage)

Philippines Time Zone Reality: 12-hour difference with the US West Coast. That’s either your biggest advantage or your operational nightmare.

Our guide on optimizing time zones for offshore development shows how to turn this challenge into a competitive advantage.

The 24-Hour Development Cycle

- US Morning (9 AM PST): Review overnight work, provide feedback

- Overlap Hours (6-9 AM PST): Real-time collaboration and meetings

- US Afternoon: Detailed handoff documentation and task assignment

- Philippines Development: Complex development work while the US sleeps

Technology Stack for Global Teams

- Communication: Slack + Zoom for overlap hours

- Project Management: Jira with Philippines-friendly workflows

- Documentation: Confluence for async knowledge sharing

- Code Management: GitHub with detailed PR requirements

Global Remote Team Management Compliance: Country-Specific Matrix

Philippines Compliance Deep Dive

Employment Law Essentials

- Probationary Period: 6 months maximum

- Regular Employee Benefits: SSS, PhilHealth, Pag-IBIG contributions

- 13th Month Pay: Mandatory bonus equal to 1/12 annual salary

- Service Incentive Leave: 5 days minimum paid leave

- Separation Pay: Required for certain termination types

The Philippines Labor Code provides the complete legal framework for employment relationships.

Tax Obligations

- Withholding Tax: Progressive rates from 0-35%

- SSS Contributions: Employer and employee portions

- PhilHealth: Universal healthcare contributions

- Pag-IBIG: Housing fund contributions

Key Philippines Holidays (Plan Around These)

- New Year’s Day, Maundy Thursday, Good Friday

- Araw ng Kagitingan, Labor Day, Independence Day

- National Heroes Day, All Saints Day, Rizal Day, Christmas Day

Cultural Integration Specifics

- Pakikipagkapwa: Shared identity and relationships matter

- Utang na Loob: Debt of gratitude influences behavior

- Hiya: Shame avoidance affects communication

- Bayanihan: Community spirit drives team dynamics

India Comparison Framework

When to Choose India

- Larger talent pool for specialized skills

- Strong English proficiency

- Established IT legal frameworks

- Better time zone alignment with Europe

Learn more about India vs. the Philippines for offshore development to make the right choice for your team.

When to Choose the Philippines

- Better cultural alignment with US business practices

- Stronger communication skills

- More flexible working arrangements

- Better time zone for the US West Coast

Ukraine/Eastern Europe Framework

Advantages

- Strong technical skills

- EU data protection compliance

- Better time zone for the US East Coast

- Growing tech ecosystem

Risks

- Political instability

- Complex labor laws

- Higher costs than in Asia

- Cultural integration challenges

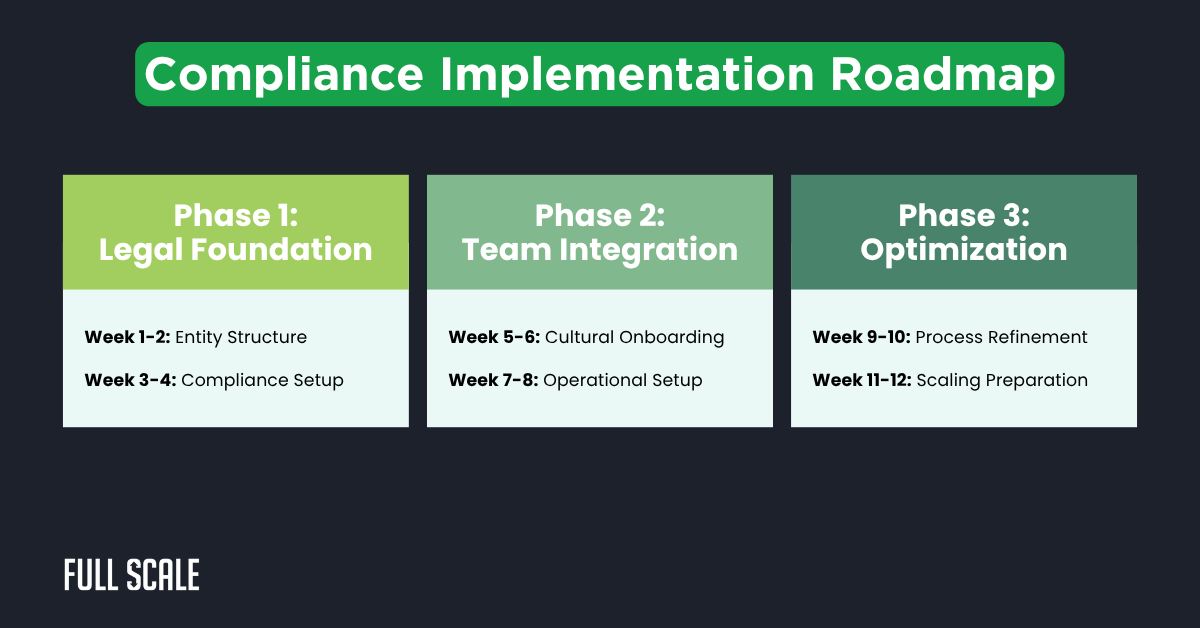

Global Remote Team Management Compliance Implementation Roadmap

Phase 1: Legal Foundation (Weeks 1-4)

Week 1-2: Entity Structure

- Decide: Direct hire vs. EOR vs. Local entity

- Register with the Philippines BIR if needed

- Set up payroll and benefits systems

- Draft employment contracts

Week 3-4: Compliance Setup

- Implement data protection measures

- Set up tax withholding systems

- Create IP protection agreements

- Establish legal documentation

Phase 2: Team Integration (Weeks 5-8)

Week 5-6: Cultural Onboarding

- Cultural orientation for both teams

- Communication protocol training

- Buddy system implementation

- Initial team-building activities

Week 7-8: Operational Setup

- Time zone workflow implementation

- Project management system setup

- Performance metrics establishment

- Regular meeting schedules

Phase 3: Optimization (Weeks 9-12)

Week 9-10: Process Refinement

- Feedback collection and analysis

- Workflow optimization

- Communication improvement

- Cultural integration assessment

Week 11-12: Scaling Preparation

- Document proven processes

- Create hiring and onboarding procedures

- Establish quality control measures

- Plan for team expansion

Scaling and Exit Strategy Framework

Smart Scaling Strategies

When to Scale Up

- Current team operating at 85%+ efficiency for 2+ months

- Clear demand for additional capacity

- Cultural integration processes have proven effective

- Compliance framework handling the current team smoothly

Scaling Implementation

- Phase 1: Add 1-2 developers to the existing team structure

- Phase 2: Create specialized teams (frontend, backend, DevOps)

- Phase 3: Establish team leads and local management structure

- Phase 4: Multiple project teams with cross-functional capabilities

Scaling Timeline

- Weeks 1-2: Recruitment and cultural screening

- Weeks 3-4: Technical interviews and team integration planning

- Weeks 5-6: Onboarding and buddy system implementation

- Weeks 7-8: Full productivity integration and performance monitoring

Exit Strategy Planning

Planned Termination Procedures: Under the Philippines’ labor law, termination requires specific procedures and often severance pay.

Authorized Causes (No Severance Required)

- Serious misconduct

- Willful disobedience

- Gross and habitual neglect of duties

- Fraud or breach of trust

Just Causes (Severance Pay Required)

- Installation of labor-saving devices

- Redundancy or surplus employees

- Retrenchment to prevent losses

- Closure or cessation of operation

Severance Pay Requirements

- Redundancy: 1 month pay per year of service

- Retrenchment: 1/2 month pay per year of service

- Business closure: 1 month pay per year of service

- Minimum: 1 month pay regardless of tenure

Exit Strategy Best Practices

- 30-day notice minimum for termination (60 days for redundancy)

- Proper documentation of performance issues or business needs

- Knowledge transfer protocols to prevent IP loss

- Access revocation procedures for security

- Final pay processing within legal timeframes

Emergency Exit Procedures

- Political instability: Pre-arranged alternative locations (India, Vietnam)

- Natural disasters: Remote work continuity plans

- Economic disruption: Currency hedging and alternative payment methods

- Regulatory changes: Legal compliance updates and adaptation strategies

Project Transition Framework

- Documentation requirements: All code commented and documented

- Knowledge transfer sessions: Recorded for future reference

- Handoff procedures: Clear task and context transfer

- Client communication: Transparent transition management

Risk Mitigation Strategies

Legal Risk Protection

Employment Misclassification Insurance

- Professional liability coverage

- Employment practices liability

- Legal defense cost coverage

Consider working with global EOR (Employer of Record) services to mitigate classification risks entirely.

Contract Protections

- Clear IP ownership clauses

- Dispute resolution mechanisms

- Termination procedures

- Non-compete agreements (where enforceable)

Intellectual Property Protection Framework

The IP Security Reality: Your Philippines developers will access source code, proprietary algorithms, and trade secrets. Without proper IP protection, you’re one disgruntled developer away from losing your competitive advantage.

Code Repository Security Measures

- Multi-factor authentication for all repository access

- Role-based permissions limiting code access by project

- Audit logging for all code downloads and commits

- Watermarked code sections for tracking

- Regular access reviews and deprovisioning

Legal IP Protection

- Comprehensive NDAs: Philippines-compliant non-disclosure agreements

- IP Assignment Agreements: Clear ownership transfer of all work product

- Trade Secret Protocols: Documentation of what constitutes confidential information

- Copyright Registration: Protect key algorithms and unique implementations

- Work-for-hire Clauses: Ensure automatic IP ownership under Philippine law

Technical Safeguards

- VPN-only access to development environments

- Code obfuscation for sensitive algorithms

- Separate environments for different security levels

- Regular security audits and penetration testing

- Encrypted communication for all technical discussions

Real Example: A fintech client had developers access their core trading algorithm through unsecured connections. One developer saved the code locally before leaving.

Cost: $2M in competitive advantage loss and legal fees.

Operational Risk Management

Communication Backup Systems

- Multiple communication channels

- Emergency contact procedures

- Documentation systems

- Regular protocol testing

Quality Assurance Framework

- Code review requirements

- Testing protocols

- Performance monitoring

- Regular audits

Financial Risk Controls

Cost Management

- Fixed-price contracts where possible

- Currency hedging for large teams

- Budget reserves for compliance costs

- Regular cost analysis

Total Cost Analysis: The Real Numbers

The Hidden Cost Reality: Most CTOs focus on developer hourly rates and miss 40% of the total cost. Here’s the complete software development cost picture:

Philippines Developer Costs (Monthly)

- Senior Developer: $2,500-$4,000

- Mid-level Developer: $1,800-$2,800

- Junior Developer: $1,200-$2,000

Additional Compliance Costs (Monthly per developer)

- Employment benefits: $300-$500 (SSS, PhilHealth, 13th month pay)

- Legal compliance: $150-$300 (contracts, labor law adherence)

- Tax obligations: $200-$400 (withholding, BIR requirements)

- Infrastructure: $100-$200 (VPN, security tools, communication)

- Management overhead: $200-$400 (cultural integration, performance monitoring)

Total Monthly Cost per Senior Developer: $3,450-$5,500

ROI Calculation Framework

US Developer Equivalent Costs

- Senior US Developer: $12,000-$18,000/month (salary + benefits + overhead)

- Recruitment costs: $15,000-$25,000 per hire

- Onboarding time: 3-6 months to full productivity

Philippines Developer ROI

- Cost savings: 65-70% compared to the US equivalent

- Break-even point: 4-6 months, including setup costs

- Annual savings per developer: $85,000-$150,000

- Setup investment recovery: Within the first year for teams of 3+ developers

Break-Even Analysis

- Team size 1-2 developers: 8-12 months to ROI positive

- Team size 3-5 developers: 4-6 months to ROI positive

- Team size 6+ developers: 2-4 months to ROI positive

Hidden Risk Costs to Budget For

- Legal penalties: $50K-$500K for misclassification (budget 2-5% of team costs)

- Compliance audits: $10K-$25K annually for legal reviews

- Cultural integration: $5K-$15K initial investment plus ongoing training

- Technology infrastructure: $2K-$5K setup plus $500-$1K monthly per developer

The Bottom Line: Making Global Teams Work

Global remote team management compliance isn’t about finding cheaper developers. It’s about building legal and operational frameworks that make offshore development safer and more productive than local hiring.

The companies that succeed don’t wing it. They build systems. They invest in compliance. They understand that cultural integration isn’t optional—it’s the foundation that makes everything else work.

Three Critical Success Factors

- Legal compliance is a competitive advantage. Companies with solid frameworks move faster because they don’t waste time fixing legal problems.

- Cultural integration multiplies technical skills. A culturally aligned team of good developers outperforms a disconnected team of great developers.

- Process design beats talent acquisition. Right systems make average developers perform like stars. Wrong systems make stars look average.

Ready to build a global development team without the legal headaches? Start with proper global remote team management compliance. Get the foundation right, and everything else becomes possible.

Next Steps

- Schedule a compliance audit of your current setup

- Connect with legal experts in your target countries

- Begin cultural integration planning with our Cultural Integration Framework

For companies ready to scale without the compliance complexity, Full Scale’s staff augmentation model handles all legal requirements while providing direct access to vetted Philippines developers.

The maze is complex, but the path is clear. Build the framework first, then scale with confidence.

Schedule An Offshore Project Consultation

Matt Watson is a serial tech entrepreneur who has started four companies and had a nine-figure exit. He was the founder and CTO of VinSolutions, the #1 CRM software used in today’s automotive industry. He has over twenty years of experience working as a tech CTO and building cutting-edge SaaS solutions.

As the CEO of Full Scale, he has helped over 100 tech companies build their software services and development teams. Full Scale specializes in helping tech companies grow by augmenting their in-house teams with software development talent from the Philippines.

Matt hosts Startup Hustle, a top podcast about entrepreneurship with over 6 million downloads. He has a wealth of knowledge about startups and business from his personal experience and from interviewing hundreds of other entrepreneurs.